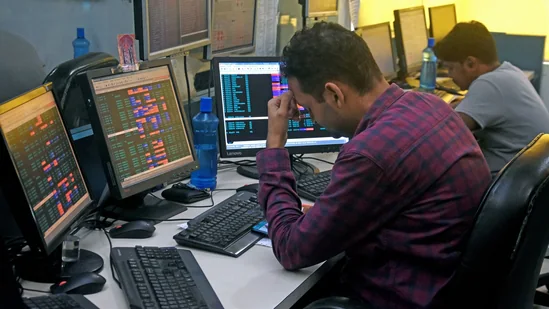

Sensex falls more than 900 points, Nifty extends loss below 22,000 mark

The crash defies the global trade setup as the S&P500 hit a record high overnights and FII’s also bought Indian shares and invest $3 billion in this month yet

Sensex fell over 900 points and reached below the 73,000 level while Nifty dropped over 1%, extending the loss to below the 22,000 mark on 13th March. It was not a great day for small cap investors since December 2022 which fell 5% while the midcaps lost 3%. Microcaps and SME stock indices also dropped around 5% each. With this, market capitalisation of all BSE-listed stocks reduced by ₹12 lakh crore and is currently at ₹374 lakh crore.

The crash defies the global trade setup as the S&P500 hit a record high overnights and FII’s also bought Indian shares and invest $3 billion in this month yet.

What caused the fall in Sensex and Nifty?

1) SEBI stress test could be a reason for the fall as SEBI chairperson Madhabi Puri Buch put out a froth on midcaps and smallcaps. Madhabi Puri Buch said, “There are pockets of froth in the market. Some people call it a bubble, some may call it froth. It may not be appropriate to allow that froth to keep building.”

2) SEBI chief also warned that valuation parameters are off the charts and not backed by fundamentals leading to “irrational exuberance”.

3) Another potential reason for the fall is that after the SEBI chairperson’s comments, ICICI Prudential Mutual Fund temporarily suspended fresh subscriptions via lumpsum mode to smallcap and midcap funds.

4) The fourth reason is the heavy selling pressure faced by the Indian stock market as majority of the indices ended in red which included smallcap and midcap indices. In the BSE Smallcap index over 80 per cent stocks have recorded negative returns since February 19. In the same period, Nifty has gained nearly one per cent.

You might also be interested in – Supreme Court rejects SIT probe, favours SEBI investigation in Adani Hindenburg case