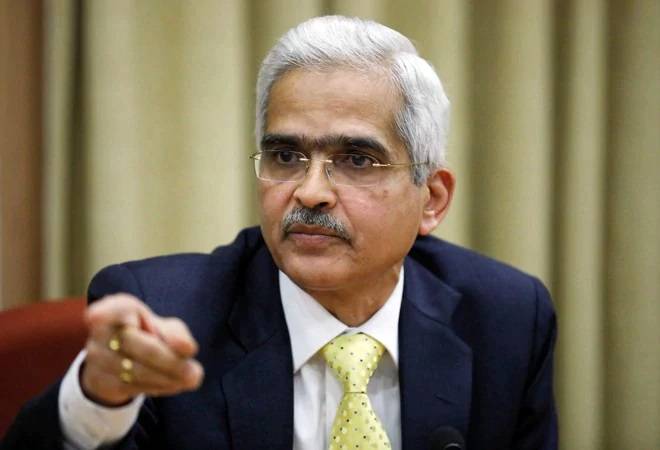

What we learned about today’s speech of RBI Governor

Reserve Bank of India (RBI) Governor Shaktikanta Das announced several schemes, such as the second round of loan restructuring and other relief measures.

The governor of RBI addressed the nation on 5th May regarding the financial situation in the country amid the ongoing corona scare. Lockdowns and other COVID-induced restrictions have been imposed in many states, which is expected to hurt the economy. Das announced many schemes, such as the second round of loan restructuring and other relief measures.

He added that RBI will continue to monitor emerging situation, using all resources. India had flattened the inflation curve but the situation altered. He also added that the quarantine facility of the RBI continues to operate with more than 200 officers working away from their homes. He announced that the second purchase of G-SEC for Rs 35,000 crore under G-SAP 1.0 will be conducted on May 20, 2021. Among liquidity measures, he announced on-tap liquidity window of Rs 50,000 crore with tenure of up to 3 years at repo rate being opened till March 31, 2022. RBI also announced targeted long-term repo operation for small finance banks (SFBs) of up to Rs 10,000 crore. This will be used for lending of up to Rs 10 lakh per borrower. Das said that it is during the darkest moments that we must focus on the light. “We have lessons to draw from our experience of last year when as a nation we came together and overcame the once in a generation challenge imposed by the first wave of the pandemic,” Das said. “Our faith should be like an ever-burning lamp which not only gives us light, but also illuminates the surroundings,” Das concluded.

The RBI has augmented fiscal support measures from Modi’s government with loan holidays and cash injections, as well as by cutting interest rates. It has pledged to keep monetary policy loose though its room to act has been constrained by inflation concerns.