Repo rate remained unchanged at 6.5%: RBI monetary policy committee meeting

RBI Monetary Policy: The rate-setting committee decided to continue with its stance of 'withdrawal of accommodation’

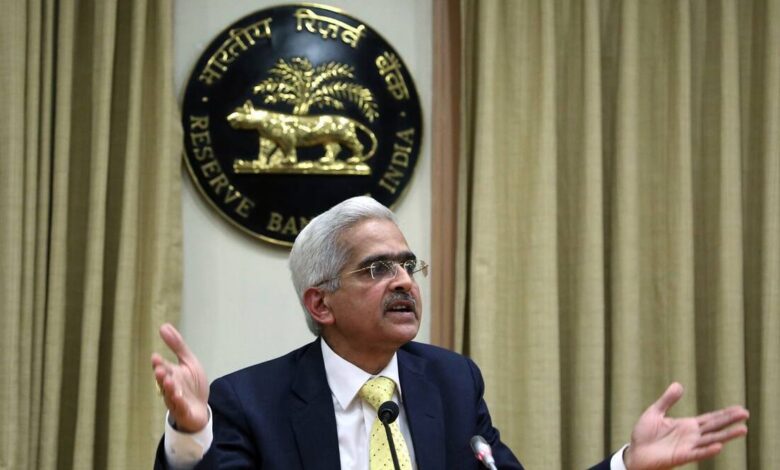

On Thursday, the Reserve Bank of India’s Monetary Policy Committee (MPC) declared its unanimous decision to maintain the repo rate without any further increase. Governor Shaktikanta Das announced this outcome, indicating the committee’s collective agreement on the matter.

“The MPC decided unanimously to keep the policy change unchanged at 6.5%,” Das said.

For the official statement: click here

The MPC also decided to continue with its stance of “withdrawal of accommodation”, MPC will take further decisions “promptly and appropriately as required,” he added.

The committee maintained the GDP growth projection for FY24 at 6.5 percent, with individual quarterly projections of 8% for Q1, 6.5% for Q2, 6% for Q3, and 5.7% for Q4.

Additionally, the MPC revised the inflation projection for FY24 to 5.1%, slightly lower than the previous estimate of 5.2%. The Governor, Mr. Das, highlighted that inflation is anticipated to remain above 5% throughout FY24.

“Goal is to reach the targeted 4% inflation going forward, our monetary policy actions are yielding desired results giving us space to keep rates unchanged in this meeting,” he said.

In his speech, Das also said that India’s forex reserves stood at $595.1 billion on June 2. Moreover, the current account deficit is expected to have moderated further in the last quarter of the previous financial year and “should be eminently manageable” in FY24.

Between May 2022 and February 2023, the Reserve Bank of India (RBI) implemented a series of repo rate hikes, totaling 250 basis points and raising it to 6.5%. However, in April 2023, the Monetary Policy Committee (MPC) decided to halt further rate increases. RBI Governor Shaktikanta Das emphasized that this decision represented a pause rather than a complete shift in policy, indicating that the possibility of future tightening still remained.

The consumer price index-based (CPI) inflation, a crucial factor in monetary policymaking, declined to a low of 4.7% year-on-year (YoY) in April, marking an 18-month low. This figure was well within the RBI’s target band of 2-6%.