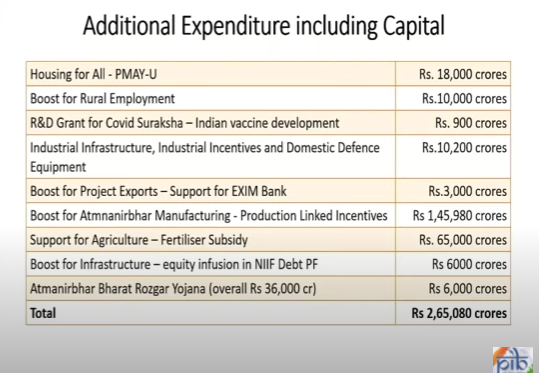

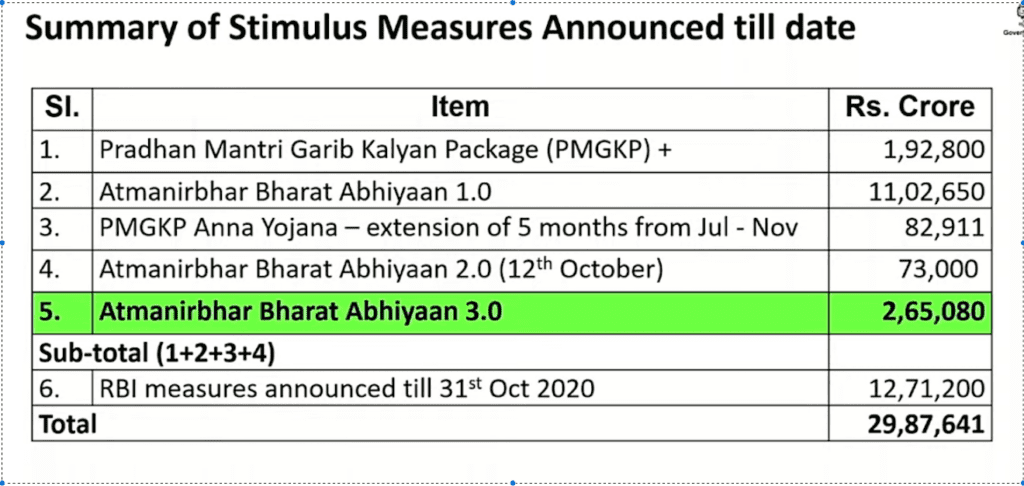

Union Finance Minister Nirmala Sitharaman announced 12 fresh stimulus measures under the Atmanirbhar 3.0 stimulus package, amounting to Rs 2.65 lakh crore. The fresh stimulus package, which has been in the works for more than three months, focused on helping stressed sectors, middle income groups, MSMEs and more.

The new measures are mostly focused on generating employment and boosting labour-intrusive sectors like real estate and manufacturing. Nirmala Sitharaman also announced a fresh scheme to incentivise new employment under the Atmanirbhar Bharat Rozgar Yojana. The existing Emergency Credit Line Guarantee Scheme has also been extended till March 31, 2021.

The Atmanirbhar Bharat Rozgar Yojana will create more jobs, and the income tax relief for first-time home-buyers will boost demand in the residential real estate sector, Ms Sitharaman said in a media briefing.

The employment generation incentives will cover all companies registered under the Employees’ Provident Fund Organisation (EPFO) on recruitment of eligible new employees.

The scheme will cover those who were never covered under the retirement fund scheme or those who lost their jobs during the March-September period.

The Atmanirbhar Bharat Rozgar scheme will come into force from October 1 with September as the base month, and will continue till June 30 next year.

Companies with less than 50 employees must recruit at least two new employees, and those with more than 50 employees must hire at least five, to be eligible for the scheme.

For companies with up to 1,000 EPFO-registered employees earning up to ₹ 15,000 per month, the central government will cover the 12 per cent contribution each of the employee and the employer for next two years. The move is aimed at easing the financial burden on companies for creating jobs.

The government also declared income tax relief for first-time buyers of houses costing up to ₹ 2 crore.

Ms Sitharaman doubled the differential between circle rate (stamp duty value) and agreement value (purchase value) for primary sale of residential houses worth up to ₹ 2 crore, from 10 per cent to 20 per cent.

For companies with up to 1,000 EPFO-registered employees earning up to ₹ 15,000 per month, the central government will cover the 12 per cent contribution each of the employee and the employer for next two years. The move is aimed at easing the financial burden on companies for creating jobs.

The government also declared income tax relief for first-time buyers of houses costing up to ₹ 2 crore.

Ms Sitharaman doubled the differential between circle rate (stamp duty value) and agreement value (purchase value) for primary sale of residential houses worth up to ₹ 2 crore, from 10 per cent to 20 per cent.

Apart from this, Sitharaman spoke about Rs 900 crore provided by Covid Suraksha Mission for research and development of the Indian Covid-19 Vaccine to department of bio-technology.